Construction organisations focused on projects all share a common goal: ensuring project profitability.

Project margins vary across industries, with the construction sector typically ranking lower, where a 4% margin is considered favourable.

Given the combination of narrow margins, high unpredictability, and intense competition, both locally and globally, it doesn’t take much for a profitable project to turn into a loss-making venture, jeopardising the entire business.

Recent years have seen this challenge exacerbated by economic conditions, labour shortages, and disruptions in the supply chain. Coupled with longstanding industry hurdles, these factors continue to elevate risks for construction and engineering firms.

Consequently, robust project financial control is no longer a luxury but an essential requirement.

Find out more below about what is required for effective project financial control and how IFS Cloud delivers this.

So, how well do companies manage project financial control?

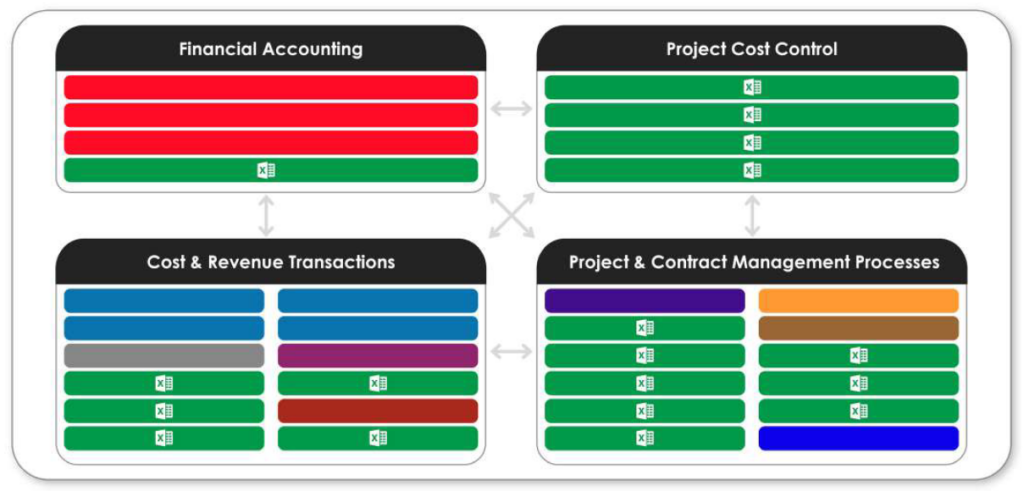

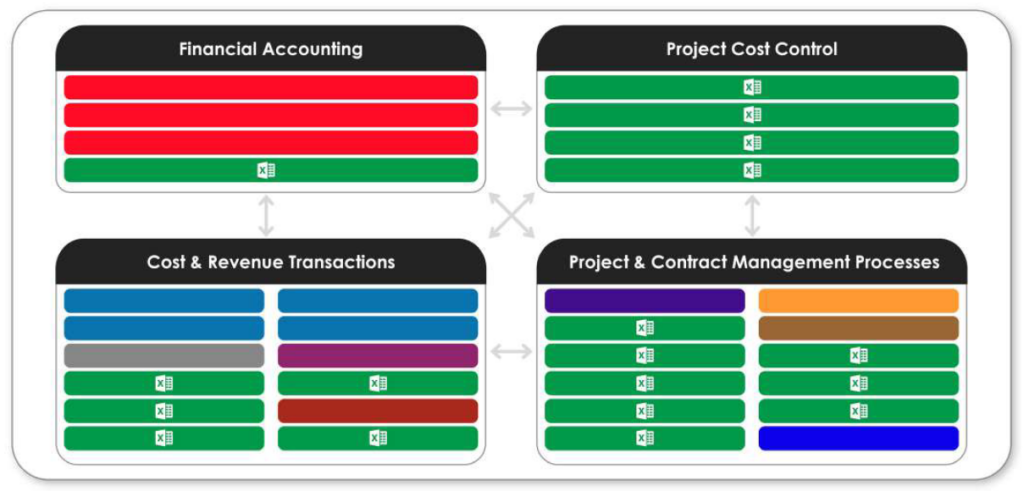

Simply put, not great! Effective Project Financial Control goes beyond basic accounting systems—it encompasses four crucial areas:

- Financial Accounting

- Cost and Revenue Transactions

- Project and Contract Management

- Project Cost Control

While every established business has an accounting system in place, managing project financial control effectively requires a more comprehensive approach. Merely implementing a robust accounting system falls short because these four key areas must interact seamlessly to provide a fully integrated solution. A standalone accounting system overlooks critical elements such as risks, cash flow, contract changes, and forecasts, essential for maintaining project margins.

Excel - The Traditional "Go To" alongside Best-of Breed Systems

Regrettably, many companies currently navigate project financial control using a fragmented landscape depicted as shown on the above—comprising various best-of-breed systems and numerous disconnected Excel spreadsheets.

This approach leads to sluggish and inefficient information processing, inaccuracies, and susceptibility to manipulation, ultimately presenting management with a distorted view of reality.

Integrating these disparate systems to enable necessary interactions demands dedicated IT expertise due to differing data structures and technology architectures. Moreover, transferring information inaccurately between systems or integrating with static spreadsheets fails to achieve real-time data sharing.

4 Pillars of Effective Project Financial Control

Financial Accounting

A top-tier accounting system is essential, especially for project accounting, seamless integration with cost and revenue transactions, and robust project cost control.

Additionally, supporting group consolidation is advantageous for organisations with multiple legal entities and joint ventures.

Cost & Revenue Transactions

A robust financial accounting solution is essential for comprehensive project financial control. Integration with all cost and revenue transactions ensures data accuracy, eliminating manual interventions and enhancing efficiency and real-time analysis empowers management with deeper project insights. For construction and engineering firms, the software must support various transaction types beyond standard purchasing to be effective.

Project & Contract Management

This vital area, often managed with standalone Excel sheets, requires more robust solutions. Referred to as Commercial Management by some, it involves sales and subcontract management, contract and project change management, Risk and Opportunity management, pre-contract support, project progress tracking, earned value measurement, and integration of project plans with sub-plans like engineering, procurement, manufacturing, labor plans, equipment rental, and construction site plans—all essential for accurate project cost and revenue forecasting.

Project Cost Control

This area is widely seen as the most crucial, as it involves setting project budgets and forecasting future outcomes. To ensure effectiveness and accuracy, it must be fully integrated with other areas. For instance, the project estimate should form the basis for the budget, while current sales and subcontract values inform future project cost and revenue forecasts. Moreover, approved and unapproved contract changes should be automatically factored into the project forecast. Sub-plans also contribute to a more precise project financial forecast.

Choose IFS - Delivering Integrated & Effective Project Financial Control

Companies looking to implement best-in-class project financial control recognise that they need an integrated solution. IFS delivers a holistic and integrated project financial control solution, providing accurate, timely and trusted information with one single version of the truth.

- Improved Control & Governance

- Accurate Data & Timely Information

- Improved Project Predictability

- Improved Change Control

- Estimate Flows to Budget & Execution

- Reduced Project & Business Risk

- Accurate Cash Planning

- Accurate Progress Tracking

- Improved Analysis

- Reduced Dependency on Excel

- Improved Efficiency, Profitability & Project Margins

- Accurate Costs & Accruals

- Faster Period End Close

- Auditable

- Accurate Data & Timely Information

- More Informed & Timely Descision-Making

- Accurate Earned Value

- Lessons Learned & Continuous Improvement

- Increased Labour Efficiency

- Reduced Cost

As an IFS Partner in Construction, Wyre Solutions understands your business’s needs and requirements. Please reach out to us today to discuss your ERP transformation. Gone were the days of spreadsheets, and welcome in the benefits of IFS Cloud.